aadi

Option Buying vs Selling: What's the Difference and Why It Matters"

In last vlog as we discuss about what are options ,eg. call option and put option

but in call option we can take trade on both side like call option buying and call option selling

same like put option buying and put option selling ….

if your prediction or analysis on bullish side means you think your stock or index price will go up

so you buy a call but what if i told you can sell put option either

lets take an example of Reliance share

For example Reliance last traded price (LTP) is Rs. 1000, so if your view is buy side than you have to take 1000 CE or you may sell 1000 PE. If Reliance stock price gets increase than in both cases you will be profitable. But in call side it depends on your option premium price and expiry date of option.

For Example Reliance

| case 1 | Reliance price increase from 1000 to 1020 | ||||||

| Reliance | Stock price | premium (1st May) | stock price at expiry | premium (29may) | |||

| 1000 | 39 | 1020 | 20 | ||||

| case 2 | reliance price increase from 1000 to 1050 | ||||||

| 1000 | 39 | 1050 | 50 |

In case 1 Reliance share price increase from 1000 to 1020 in 29 day but our premium price decreases from 39 to 20 so we have to pay loss of 19 point even if after our correct analysis..

but in case 2 reliance share price rose from 1000 to 1050 in whole month and at expiry date (29 may) premium price is 50

so we have profit of just 50-39=19 … just 19 points

but in option selling in this case as we discuss we have to sell put if our analysis on bullish side …

so at 1 may 1000pe is traded on value of 35 so at 29 may which is our expiry date of this month options premium of this 1000 pe of reliance share near by 0

so in this case we have profit of 39 points …. simple reliance has to close above its selling strike price … in this case 1000 is our strike price

But but but it not this much simple in selling ….. because risk is so much in selling …

further discussion we will do in next blog……

Option buying vs Option selling Read More »

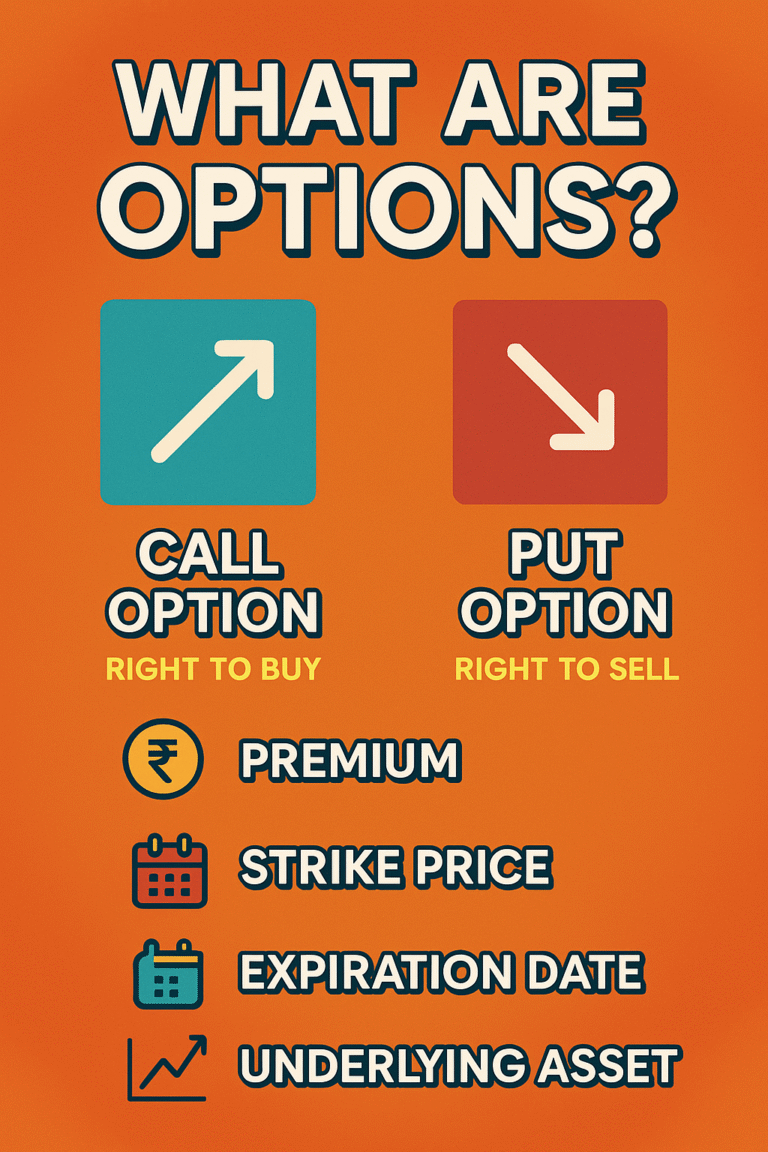

what are options ??

Options are contracts in the world of finance that grant the buyer the right, but not the obligation, to buy or sell an underlying asset at a particular price (referred to as the striking price) prior to or on a specific date (the expiration date). Two primary categories of alternatives exist:

The right to purchase the asset is granted via a call option.

The right to sell the asset is granted to the holder by a put option.

It is just basic think you may know about options but options are very vast topic …

there are so many terms like Premium, Strike price, expiry date effect option price

eg. when the expiry date is near premium of options on lower side

strike price also affect premium price of options

3 types of strike price 1. ATM 2.ITM and 3. OTM

all these we will discuss in upcoming blogs so stay tuned…..

A Call Option: What Is It?

Using a call option, the buyer gets the right to purchase an asset before the contract expires at a specific price, known as the strike price.

As an illustration, let’s say you purchase a call option on ABC stock with a Rs.150 strike price.

You can still purchase ABC company shares for Rs.150 and then sell it for a profit at the market price if its price increases to Rs.170.

You are not required to purchase the stock if it never rises above Rs.150. Only the premium—the amount you paid for the option—is lost.

when to buy call option?

You believe the stock price will go up.

You want to control a stock without buying it outright.

You want to limit your loss to just the option’s premium.

What Is a Put Option?

Before the contract expires, the buyer of a put option has the right to sell the asset at the strike price.

Let’s say you purchase a put option on ABC stock with a Rs.150 strike price.

You can still turn a profit by selling ABC stock for Rs.150 even if it drops to Rs.120

You just let the option expire and only lose the premium if the stock remains above Rs.150

When to Use Put Options:

You believe the stock price will go down.

You want to protect your investments if the market falls (hedging).

You want a flexible way to bet against a stock

Here we only discussed about two types of option and buying of these options …

on upcoming blogs will discuss about option selling ,its pro and cons. and what is premium in options

Call option and Put option Read More »