Option Buying vs Selling: What's the Difference and Why It Matters"

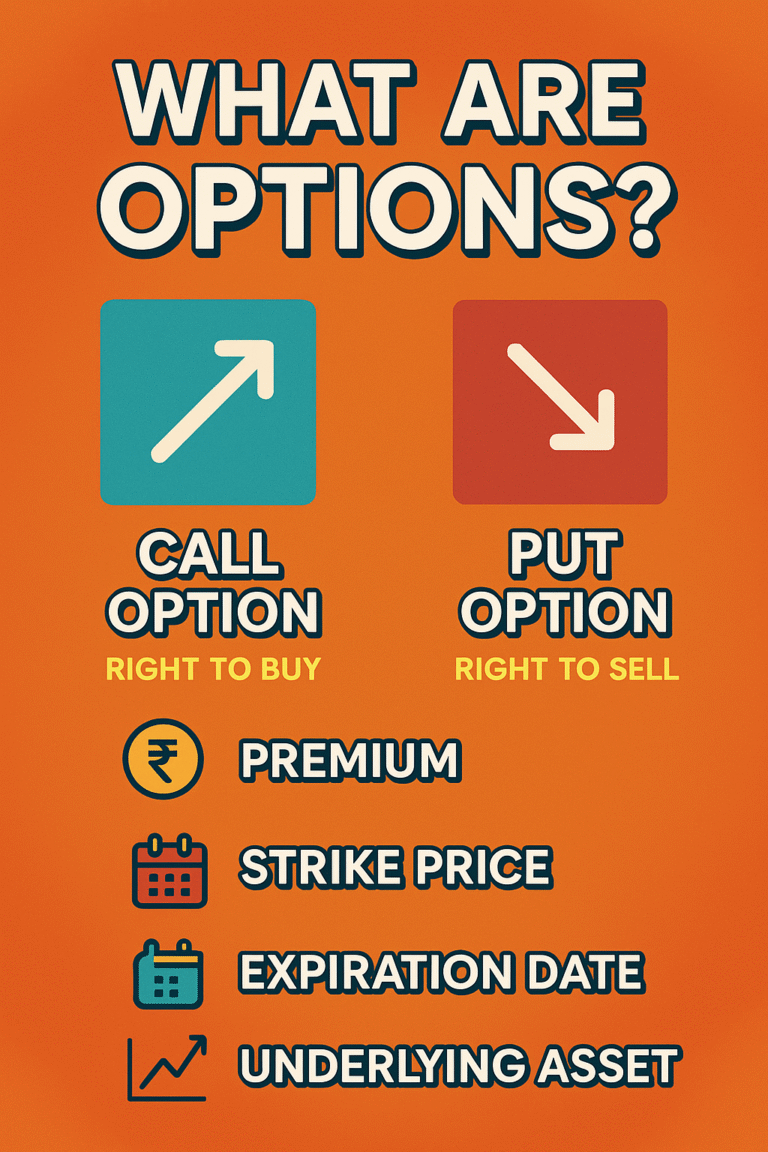

In last vlog as we discuss about what are options ,eg. call option and put option

but in call option we can take trade on both side like call option buying and call option selling

same like put option buying and put option selling ….

if your prediction or analysis on bullish side means you think your stock or index price will go up

so you buy a call but what if i told you can sell put option either

lets take an example of Reliance share

For example Reliance last traded price (LTP) is Rs. 1000, so if your view is buy side than you have to take 1000 CE or you may sell 1000 PE. If Reliance stock price gets increase than in both cases you will be profitable. But in call side it depends on your option premium price and expiry date of option.

For Example Reliance

| case 1 | Reliance price increase from 1000 to 1020 | ||||||

| Reliance | Stock price | premium (1st May) | stock price at expiry | premium (29may) | |||

| 1000 | 39 | 1020 | 20 | ||||

| case 2 | reliance price increase from 1000 to 1050 | ||||||

| 1000 | 39 | 1050 | 50 |

In case 1 Reliance share price increase from 1000 to 1020 in 29 day but our premium price decreases from 39 to 20 so we have to pay loss of 19 point even if after our correct analysis..

but in case 2 reliance share price rose from 1000 to 1050 in whole month and at expiry date (29 may) premium price is 50

so we have profit of just 50-39=19 … just 19 points

but in option selling in this case as we discuss we have to sell put if our analysis on bullish side …

so at 1 may 1000pe is traded on value of 35 so at 29 may which is our expiry date of this month options premium of this 1000 pe of reliance share near by 0

so in this case we have profit of 39 points …. simple reliance has to close above its selling strike price … in this case 1000 is our strike price

But but but it not this much simple in selling ….. because risk is so much in selling …

further discussion we will do in next blog……

Option buying vs Option selling Read More »